If you lead IoT initiatives—whether in manufacturing, utilities, transportation, smart buildings, or connected products—you’ve likely faced a deceptively simple question:

Should we build our IoT platform in-house, or should we buy one?

The question persists because IoT success depends less on having “a platform” and more on reliably delivering outcomes at scale: higher uptime, lower energy spend, predictive maintenance, quality improvements, safety, compliance, and new digital services.

- Build often means longer timelines, higher and less predictable engineering costs, and ongoing maintenance risk.

- Buy often means faster go-live, predictable platform cost, and a proven scalability baseline.

- The “ROI reality check” is usually about time-to-value, total cost of ownership, scalability, and risk.

This guide is written to help you make the decision without ideology. Not “build is always best” or “buy is always best,” but what creates the highest ROI with the lowest operational and execution risk for your context.

In most enterprise IoT programs, “Buy + configure + extend” wins because the biggest hidden costs aren’t the first prototype—they’re the years of operating, securing, scaling, and evolving the platform.

The ROI reality check

- Time to deploy: Building commonly stretches to 18+ months. Buying can often reach production in 8–12 weeks for initial scope.

- Time to value: Build programs can drift toward 24 months to meaningful enterprise value; buy approaches can target ∼3 months for initial outcomes.

- TCO: Build has “hidden overheads” (SRE/DevOps, security, observability, upgrades, support, on-call, compliance). Buy is usually more predictable and often lower over time if you manage vendor economics and avoid uncontrolled feature sprawl.

- Scalability: Build starts from scratch; buy platforms are designed to handle fleet scale, multi-tenancy, and enterprise ops patterns.

- Risk: Build has higher project risk (schedule slippage, security gaps, talent churn). Buy can be lower risk if the vendor is truly production-proven and your architecture avoids lock-in traps.

A practical rule of thumb

- Build when you need a differentiating capability that cannot be achieved with configuration or extensions and the capability will remain strategically unique for years.

- Buy when your biggest constraints are time, reliability, security, compliance, and scale, and your differentiation comes from use cases, analytics, workflows, and customer experience, not from plumbing.

Build (typical reality)

- 18+ months to deploy

- High development costs

- Ongoing maintenance risk

Buy (typical reality)

- Go live in 8–12 weeks

- Predictable platform cost

- Proven and scalable

ROI Reality Check (where programs actually succeed or fail)

- Time to value: Build → 24 months? Buy → ∼3 months

- TCO: Build → hidden overheads. Buy → predictable and often lower over time

- Scalability: Build from scratch vs enterprise-ready

- Risk: High project risk vs low and proven in production

Key takeaway: Most IoT programs underestimate the cost and time of creating an enterprise-grade platform and overestimate how quickly a custom solution becomes robust, secure, observable, supportable, and scalable.

What an IoT platform actually includes (the part most ROI models miss)

Many teams evaluate “platform” as if it’s just device connectivity and dashboards. In practice, the platform is a stack of responsibilities.

The full IoT platform capability map

Below is a non-exhaustive but realistic view of what “platform” means in production:

1) Device and edge lifecycle

- Device identity and provisioning

- Secure onboarding, certificates/keys

- Firmware/OTA updates

- Configuration management

- Device health monitoring and command/control

- Edge gateways and protocol translation

- Offline operation and store-and-forward

2) Connectivity, messaging, and ingestion

- MQTT/HTTP/AMQP or proprietary protocols

- Message brokering and routing

- Guaranteed delivery patterns

- Deduplication and ordering

- Rate limiting and backpressure

- Multi-region connectivity and failover

3) Data management

- Telemetry storage (hot/warm/cold)

- Time-series optimization

- Metadata models (assets, hierarchies, tags)

- Data retention policies

- Data quality rules

- Schema evolution and versioning

4) Analytics and automation

- Rules engines and alerting

- Workflow triggers (tickets, notifications, shutdown procedures)

- Machine learning pipelines

- Feature stores, model registry, model monitoring

- Digital twins (where appropriate)

5) Application enablement

- APIs (REST/GraphQL), SDKs

- Multi-tenant support for connected products

- Role-based access control, audit logs

- Dashboards, reports, and embedded analytics

- Integration connectors (ERP, CMMS, EAM, SCADA/MES, ITSM)

6) Security, compliance, and governance

- Encryption in transit and at rest

- Certificate rotation and revocation

- Secrets management

- IAM integration (SSO, MFA, SCIM)

- Regulatory controls and auditability

- Data residency and cross-border governance

- Vulnerability management and patching cadence

7) Platform operations (the “forever costs”)

- SRE/DevOps pipelines

- Observability: logs, metrics, traces

- Incident response processes

- SLAs and error budgets

- Cost governance (FinOps)

- Upgrades and dependency management

- On-call rotations and runbooks

- Disaster recovery and business continuity

Why this matters: You can build a prototype fast. But building a platform that reliably delivers these capabilities at enterprise scale is what drives the 18–24 month timelines.

Build vs Buy: definitions and common options (including hybrid)

A realistic Build vs Buy conversation includes more than two options:

Option A: Build (from scratch)

You implement most components yourself: device services, ingestion, storage, APIs, UI, IAM integration, etc.

Pros

- Maximum control and customization

- Potential strategic differentiation

- No platform subscription economics

Cons

- High time and talent requirements

- High security and operational risk if under-resourced

- Long path to maturity and reliability

- Harder to prove compliance quickly

Option B: Buy (commercial IoT platform)

You adopt a platform that provides core services and operational patterns, then configure and extend it.

Pros

- Faster time-to-value

- Pre-built security, scalability, monitoring patterns

- Predictable pricing (if negotiated well)

- Vendor roadmaps can reduce your maintenance burden

Cons

- Vendor lock-in risk

- Feature constraints or opinionated workflows

- Integration limitations

- Platform cost can grow with scale if pricing is misaligned

Option C: Hybrid (“Buy the core, build differentiation”)

Often the best practical route:

- Buy device management + ingestion + security posture

- Build domain apps, analytics, workflows, and unique UX

Pros

- Best balance of time-to-value and differentiation

- Lower operational risk than full build

- Keeps your unique IP in your application layer

Cons

- Requires good architecture discipline

- Needs clear boundaries to avoid building a second platform accidentally

Option D: Use hyperscaler primitives (“Assemble”)

You combine cloud services (messaging, identity, storage, compute) into an IoT solution.

Pros

- High flexibility and extensibility

- Strong global infrastructure and security options

- Often cost-effective for certain patterns

Cons

- Integration and maintenance burden shifts to your team

- Still requires deep platform engineering

- Risk of “accidental complexity” across many services

The ROI model: how to calculate outcomes with fewer illusions

If you want a defensible Build vs Buy decision, you need a model that includes both time-to-value and time-to-operate.

A simple ROI model you can actually use

1) Net benefit and ROI

Define:

- B = total benefits over the evaluation window

- C = total costs over the evaluation window

Then:

- Net benefit =B−C

- ROI =(B−C)/C

2) Payback period

If benefits accrue monthly, estimate:

- C0 = upfront costs

- b = average monthly benefit

- c = average monthly operating cost

Then payback period (months) is approximately:

Payback≈C0/(b−c)

Why Build struggles here: If build delays benefits by 12–18 months, your payback clock starts late.

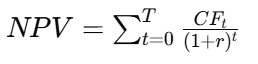

3) Discounted cash flows (NPV) for serious decisions

Let:

- C Ft be net cash flow in period t

- r be discount rate

- T be total periods

Then:

Practical insight: If Buy delivers positive CFt earlier, it often wins on NPV even if subscription costs are higher—because time-to-value dominates.

TCO breakdown: the line items that blow up Build budgets

1) Engineering (not just “developers”)

A true platform requires:

- Backend engineers (device services, APIs)

- Data engineers (pipelines, storage, governance)

- Security engineers (PKI, IAM, threat modeling)

- SRE/DevOps (reliability, incident response, automation)

- QA/performance engineers (load tests, regressions)

- Product management (roadmap, prioritization)

Hidden TCO: ongoing hiring and retention costs, plus productivity loss during turnover.

2) Reliability and operational coverage

Production IoT needs:

- On-call schedules

- Runbooks and incident postmortems

- SLOs/SLAs and alert tuning

- DR testing and regional failover planning

Hidden TCO: “weekend outages” cost more than platform licensing because they cause downtime, missed SLAs, and lost trust.

3) Security and compliance

IoT security is not optional:

- Device identity, certificates, rotation

- Secure boot/firmware signing (depending on devices)

- Vulnerability and patch response procedures

- Audit logs, access reviews, evidence retention

- Pen tests and continuous hardening

Hidden TCO: security debt compounds; remediation later costs more and may require architectural rework.

4) Integration and data semantics

Most value comes from integration:

- CMMS/EAM tickets and work orders

- ERP cost and inventory impacts

- ITSM incident workflows

- MES/SCADA context for industrial outcomes

- Customer apps for connected products

Hidden TCO: “just one more integration” becomes a roadmap killer if the platform doesn’t standardize APIs and data models.

5) FinOps and cost governance

IoT generates a lot of data. Without governance:

- Storage grows

- Query costs spike

- Message throughput costs balloon

- “Nice-to-have telemetry” becomes expensive noise

Hidden TCO: ungoverned data is a recurring budget surprise—especially at fleet scale.

Decision criteria that matter at enterprise scale

Below are the criteria that actually determine success, framed in “Build vs Buy” language.

1) Time-to-value (and the cost of delay)

Ask:

- When do we need the first measurable outcome?

- What is the cost of waiting 12 months?

If your business case depends on benefits in the next two quarters, Buy or Hybrid usually wins.

2) Total cost of ownership (not just year-one spend)

Build can look cheaper in year one if you ignore:

- Hiring ramp time

- Platform reliability work

- Security and compliance

- Ongoing maintenance and upgrades

- Support burden across sites/regions

Buy can look more expensive if you ignore:

- Negotiated pricing tiers

- Data retention policies

- Architectural choices that reduce vendor consumption charges

3) Scalability: devices, sites, tenants, and teams

Scale is multidimensional:

- Device count (thousands vs millions)

- Message volume and burst patterns

- Multi-site deployments with local constraints

- Multi-tenant SaaS model for connected products

- Multiple teams shipping features concurrently

Buying a proven platform reduces the chance you discover scaling limits late.

4) Risk (delivery, security, and operational)

Consider three risk types:

- Delivery risk: schedule slip, shifting requirements, talent churn

- Security risk: certificate mishandling, weak access controls, supply chain exposure

- Operational risk: outages, data loss, missing audit trails, failed upgrades

Build increases these risks unless you already operate similar platforms at scale.

5) Differentiation: where you truly want to be unique

Your differentiation is usually:

- Domain workflows and outcomes

- Analytics and optimization logic

- UX, reporting, and embedded insights

- Partner ecosystem and integrations

Your differentiation is rarely:

- Message brokers

- Certificate rotation

- Telemetry storage plumbing

- Generic device lifecycle tooling

6) Compliance and auditability

If you operate in regulated environments, ask:

- Can we produce audit evidence quickly?

- Do we need data residency controls?

- Are there sector-specific security expectations?

Buy platforms often provide strong baselines; Build requires disciplined compliance engineering.

7) Talent availability and organizational readiness

Build is feasible when:

- You can staff and retain a platform team

- You can support on-call and release discipline

- You have a mature SDLC, security, and operations function

If not, Buy reduces organizational strain and increases the odds of durable success.

A step-by-step decision framework you can run in 2–4 weeks

This is a practical process you can use to reach a credible decision with stakeholder buy-in.

Step 1: Define “success” in business metrics (not platform features)

Examples:

- Reduce unplanned downtime by x%

- Improve OEE by y points

- Cut energy cost per unit by z%

- Increase service attach rate by x%

- Reduce MTTR by y%

Tie metrics to time:

- What must happen in 90 days?

- What must happen in 12 months?

Step 2: Identify your “minimum lovable platform” scope

List the minimum you need for the first outcome:

- Device onboarding path

- Data ingestion method

- Storage and context model

- Alerts/workflows

- Dashboards or API outputs

- Security baseline (IAM, audit logs)

Step 3: Create a 1-page architecture boundary

Define:

- What the platform must do

- What your apps will do

- What will be delegated to edge vs cloud

This prevents “platform creep.”

Step 4: Build a TCO sheet with real line items

Include:

- One-time costs (implementation, integration, migrations)

- Ongoing costs (platform fees, cloud costs, staffing, support)

- Risk costs (expected downtime costs, incident likelihood, compliance penalties)

A practical approach: run three scenarios:

- Conservative, Expected, Aggressive

Step 5: Score Build vs Buy vs Hybrid using a weighted matrix

Here is a template you can adapt:

| Criterion | Weight | Build Score (1–5) | Buy Score (1–5) | Hybrid Score (1–5) |

|---|---|---|---|---|

| Time-to-value | 20 | |||

| TCO predictability | 10 | |||

| Scalability | 15 | |||

| Security & compliance | 15 | |||

| Integration fit | 10 | |||

| Differentiation support | 10 | |||

| Operational readiness | 10 | |||

| Vendor/lock-in risk | 10 |

Compute weighted total as:

Step 6: Validate with a proof (not a promise)

- For Buy/Hybrid: require a short pilot with real devices and real data flows

- For Build: require an engineering “spike” that proves key risks (security, scale, ops)

Step 7: Decide with an explicit risk acceptance statement

A mature decision includes:

- What risks are you accepting?

- What is the mitigation plan?

- What is the “exit plan” if assumptions fail?

Use-case patterns: when Build wins vs when Buy wins

When Build tends to win

Build is justified when all (or most) of the following are true:

- Differentiation is in the platform layer

Example: a unique real-time control/optimization engine tightly coupled to proprietary hardware. - You have strong platform engineering DNA

You already operate mission-critical platforms with SRE, security, and compliance. - You can commit to multi-year investment

A platform is never “done.” You must fund it like a product. - Your business model needs deep customization

Example: multi-tenant connected product platform with unique billing, entitlements, and partner APIs that are central to revenue.

When Buy tends to win

Buy is best when any of the following are true:

- You need value fast: 8–12 weeks to production scope

- Your IoT program has stalled due to platform complexity

- You’re operating in regulated or high-risk environments

- You don’t want to staff 24/7 platform operations

- Your differentiation is in use cases and workflows, not platform plumbing

- You anticipate scaling across multiple sites, regions, or product lines quickly

When Hybrid tends to win (most common)

Hybrid wins when you:

- Buy the platform core capabilities

- Build your domain logic and UX

- Maintain clean boundaries so you can migrate if needed

Common failure modes (and how to avoid them)

Failure mode 1: “We built a prototype, therefore we can build a platform”

What happens: the prototype works for one site or one device type, then collapses at scale due to missing operations, security, and governance.

Avoid it by: requiring a platform readiness checklist: SLOs, monitoring, DR, certificate rotation, access reviews, upgrade path.

Failure mode 2: Buying a platform but treating it like a turnkey solution

What happens: you buy, but you still fail because you didn’t design data models, integrations, governance, or operating processes.

Avoid it by: staffing an internal product owner and platform architect even if you buy.

Failure mode 3: Vendor lock-in panic leads to paralysis

What happens: fear of lock-in delays decisions and prevents value delivery.

Avoid it by: designing for portability at the boundaries:

- Keep your domain model and business logic in your services

- Use event streams and normalized storage where appropriate

- Maintain an exit plan and data export capability

Failure mode 4: TCO is underestimated because “cloud is cheap”

What happens: storage and consumption costs explode at scale.

Avoid it by: designing telemetry policies:

- Sampling strategies

- Edge aggregation

- Retention tiers

- “Store less, use more” governance

Failure mode 5: Security treated as a later phase

What happens: device identities, keys, and access controls become inconsistent and unsafe.

Avoid it by: making security non-negotiable in phase one:

- Device identity and secure onboarding

- IAM integration and RBAC

- Audit logs and alerting

- Vulnerability response process

Practical checklists: requirements, vendor evaluation, and rollout

Checklist A: Requirements that matter (copy/paste into your discovery doc)

Device & Edge

- Provisioning method and scale expectations

- OTA updates and staged rollouts

- Offline operation requirements

- Device health and remote diagnostics

Data & Analytics

- Data volumes per device per day

- Latency requirements for alerts and actions

- Data retention and governance requirements

- Integration with BI and data lake strategy

Security

- SSO/MFA and RBAC requirements

- Certificate lifecycle and rotation

- Audit logging and evidence retention

- Vulnerability management expectations

Operations

- Required uptime and support model

- DR requirements and RTO/RPO targets

- Monitoring and alerting expectations

- Release cadence and change control

Business

- Subscription pricing model fit (per device, per message, per tenant, etc.)

- Contract terms, SLAs, and support response times

- Exit clauses and data portability commitments

Checklist B: Vendor evaluation questions (for Buy/Hybrid)

- What is the platform’s proven scale in production (devices, messages, tenants)?

- What security certifications and audit artifacts can they provide?

- How do they handle certificate rotation and device identity at scale?

- What is the upgrade path and backward compatibility policy?

- What integration patterns do they support (APIs, event streams, connectors)?

- How transparent is pricing at scale? What are the biggest cost drivers?

- What observability is built-in (logs/metrics/traces) and what is exposed to customers?

- What is the DR architecture and what are the tested recovery outcomes?

- How do they support multi-region and data residency needs?

- What does a realistic 8–12 week go-live look like (what scope, what assumptions)?

Checklist C: A rollout plan that avoids “pilot purgatory”

Phase 1: Prove one outcome (6–12 weeks)

- One device class, one site (or limited fleet)

- One business metric improvement

- Security baseline implemented

- Integration to one system of record (CMMS/ITSM/ERP)

Phase 2: Standardize and scale (3–6 months)

- Standard onboarding playbook

- Repeatable dashboards and workflows

- Template integrations and data models

- Site rollout pattern with governance

Phase 3: Optimize economics and reliability (6–12 months)

- FinOps policies for retention and sampling

- SLOs, incident response, DR drills

- Expanded analytics and automation

- Formal product roadmap and stakeholder steering

The decision in one sentence (if you want it that simple)

If your goal is enterprise IoT outcomes rather than building an internal software business, Buy or Hybrid is usually the highest-ROI path—because it compresses time-to-value and reduces execution risk.

Conclusion + 10 follow-on topics

Build vs Buy for IoT platforms is ultimately a choice between engineering control and speed-to-value with operational confidence:

- Building can take 18+ months and pushes significant risk into maintenance, security, and scaling.

- Buying can get you live in 8–12 weeks, with more predictable costs and proven scalability—if you choose the right platform and architect your boundaries well.

The winning strategy for most organizations is Hybrid: buy the platform primitives that don’t differentiate you, and build the domain workflows and insights that do.